This article provides a comprehensive guide on how to stake your crypto. You will learn both the benefits of locking up your crypto as well as potential risks.

Introduction: What is Staking? Why is Staking Cryptocurrency Important and How does it Work?

Staking is one of the popular ways to earn cryptocurrency it is an easy way of growing the crypto you own. It enables holders to earn more with their crypto holdings that would otherwise just sit in their crypto wallet. You can stake your coins, which means you hold them in your wallet and run a node on the network. The more coins you stake, the higher chance you have to earn more rewards.

Cryptocurrency staking is a way of earning cryptocurrency by holding coins in your wallet. You can invest in many cryptocurrencies and earn coins without doing anything. The staking process can be complicated for newbies so it is recommended that they do their research before starting with this process.

If you’ve ever learned about how Bitcoin works, you may be aware of Proof of Work (PoW). This is the mechanism by which miners solve complex algorithms to add new blocks to the blockchain. In return, they will receive a reward. However, Proof of Work (PoW) takes a lot of effort and cost.

Crypto staking is derived from the proof-of-stake (PoS) consensus algorithm, which is a blockchain verification method that is less risky and more energy-efficient, compared to the proof-of-work (PoW) algorithm. Staking crypto gives you an opportunity to earn more of the same cryptocurrencies you currently hold. There is no fancy mining tool needed to stake crypto – only a stable internet connection and a computer is required.

How to Stake your Cryptos on Binance

Binance is an international cryptocurrency exchange that ranks among the largest cryptocurrency exchangers in the world in 2022. It provides different coin trading pairs such as Bitcoin, Litecoin, Ethereum, and other cryptocurrencies.

The main advantage of Binance is the low trading fees, which can be as low as 0.1% depending on volume and does not require users to verify their identity in order to trade on the platform. This is especially helpful for those who are just getting started with cryptocurrencies and don’t want to spend time going through all the verification processes.

This guide will show you how to stake your cryptocurrencies on Binance.

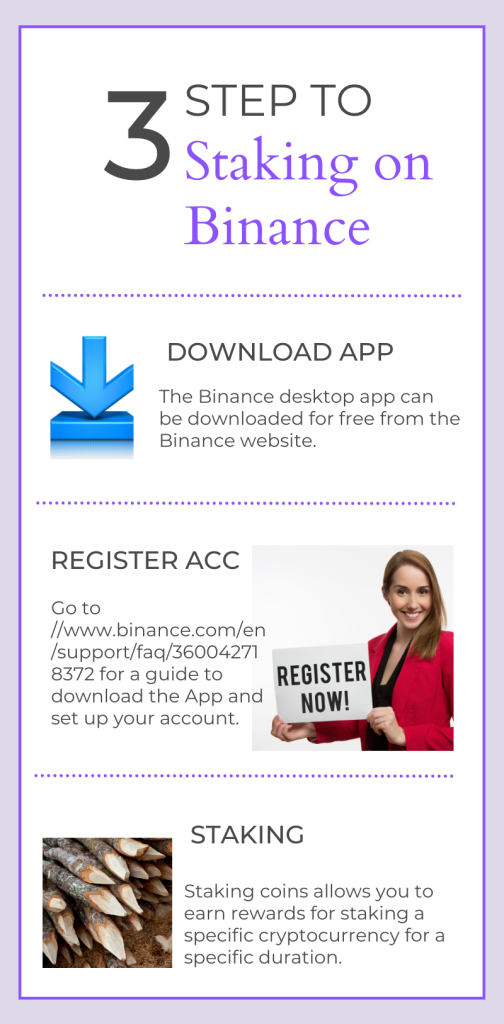

We will go over the following steps:

- Downloading and installing the Binance desktop app.

- Registering for an account with Binance

- Staking tokens on Binance

1. Downloading and installing the Binance desktop app.

The Binance desktop app can be downloaded for free from the Binance website. It features a variety of features including an intuitive trading interface, a rich list of data and charts, and the latest news. The app also allows users to trade on the go by syncing their account in real-time with their mobile devices.

2. Registering for an account with Binance

Go to //www.binance.com/en/support/faq/360042718372 for a guide to download the App and set up your account.

Alternatively there is also the option of registering for an account using an email address. There are just a few easy steps to take, they can be found here; https://www.binance.com/en/support/faq/115003764911

3. Staking tokens on Binance

Staking coins allows you to earn rewards for staking a specific cryptocurrency for a specific duration. It involves holding funds in a cryptocurrency wallet to support the security and operations of a blockchain network. Simply put, staking is the act of locking cryptocurrencies to receive rewards.

Binance Staking allows you earn rewards in an utterly simple way – all you have to do is hold your coins on the exchange.

Check out a step by step guide how to stake of Binance on the link below:

https://medium.com/coinmonks/step-by-step-guide-on-how-to-stake-coins-on-binance-exchange-and-earn-interest-4088c182601e

Why You Should Consider Staking Your Cryptocurrency with Binance

Binance is one of the world’s largest cryptocurrency exchanges. It has a wide range of cryptocurrencies available to trade and offers a variety of trading pairs.

Binance was initially based in China, but later moved its headquarters out of China following the Chinese government’s increasing regulation of cryptocurrency. Some countries have increased their regulation of trading on Binance so make sure before your begin you understand what you can do on Binance. However, Binance has its own token that can be used to pay for trades and other features within the platform. This token can also be traded on exchanges and it will not be affected by any government regulations or announcements.

The exchange charges low fees for trades and withdrawals, with no deposit fees at all for cryptocurrencies that are not Bitcoin (BTC). The only downside is that it does not support fiat currencies like US dollars or Euros.

Staking Crypto on the Binance Mobile App and an Overview of Fees

Whilst Binance charges fees for performing some other functions on its exchange, it doesn’t charge users for staking. It is one of the only major international crypto exchanges that doesn’t charge a cent for staking any of their available coins.

There are two ways to earn coins with crypto staking:

1) Locked Staking; This is by having the coin in your wallet and keeping it there for a specific amount of time. During the staking period, your cryptocurrencies will be locked and you would not have any access to these coins until the staking period is over.

2) By investing in crypto staking platforms that does all the work for you. Nerd wallet is a great place to check out the best platforms. Be aware that some of these platform may charge for their services. So make sure to check them out first.

Binance offers an amazing service where one can compound the interest one earns. This is done through the Binance Earn program. They also offer the added feature called the Auto-Subscription feature, where you will automatically compound your savings and not have to continually invest your returns.

What are the best cryptocurrencies for staking 2022?

Cryptocurrencies are digital coins that provide a way to store and exchange value. As a reward for supporting the network by providing computational power, users receive new coins.

There are many cryptocurrencies that can be staked but we have spent some time finding the best ones for you. Here is a list of top 10 best cryptocurrencies for staking:

Algorand

Avalanche

Binance Coin

Cardano

Ethereum

Polkadot

Polygon

Solana

Terra

USDC

Different Ways of Earning Cryptocurrency

There are two main ways to earn crypto coins other than straight forward staking the first is via airdrops. Airdrops are a way of distributing new coins to holders of specific coins. In order to be eligible for the airdrop, you need to have some coins in your wallet. The more coins you have, the more free ones you’ll receive. Airdrops are becoming increasingly popular among investors because they allow them to earn some free crypto without having to invest anything upfront.

The main idea is to send newly minted tokens to hundreds or thousands of different wallet addresses with the hope recipients will be more inclined to engage with the corresponding project – even if it’s only to learn how to cash out the free tokens into something else. This idea is based in finding a free discount card in your letterbox to encourage you to visit a new store in the area. However, a crypto airdrop isn’t predominantly about making the recipient spend money but rather raising awareness for new projects and services.

Reflection coins is another way to earn. They are cryptocurrencies that reward holders by employing a mechanism in which transactions are taxed and a percentage of the tax charged is redistributed to holders of the token. The mechanism of reflection tokens increases the number of ways investors can earn in DeFi as holders can earn rewards on their tokens while using it for staking and other ways of earning passive income. The process is easy, secure and transparent via the usage of smart contracts.

Reflection coins are safe as they are not involved in the frequent occurrence of massive price drops and large manipulations in newer crypto projects to some degree. Some may say that Reflection tokens are still a new concept and haven’t been tested well enough, also the transaction fees of most reflection tokens make them a bad choice for small transactions.

Is Staking Profitable & What Are The Risks?

Probably the most obvious benefit of staking your cryptocurrency is its passive income. You earn a steady % per day or even per hour on your investment, automatically. It is less risky than trading, where you can end up with huge losses very quickly.

- It’s an easy way to earn interest in your cryptocurrency holdings, and it can be used to invest in a diverse portfolio of coins that provide a high level of security and stability.

- You don’t need any expensive equipment to stake your coins like you would need to mine them.

- It’s more environmentally friendly than crypto mining.

The primary benefit of staking is that you earn more crypto, and interest rates can be very generous. In some cases, you can earn more than 100% or even 1000% per year. It’s potentially a very profitable way to invest your money. And, the only thing you need is crypto that uses the proof-of-stake model.

Staking is also a way of supporting the blockchain of a cryptocurrency you’re invested in. These cryptocurrencies rely on holders staking to verify transactions and keep everything running smoothly.

Although Staking is very low risk there are some risks too. Think carefully about the risks before you decide to do it and a decision should not be taken lightly and should be done with a lot of thought.

This is a list of some of the risks associated with staking cryptocurrency:

- Staking, also called HODLing by some, can mean that you have to lock your coins up for a certain time period. During this time, you’re unable to interact with them in any way.

- Crypto prices can vary drastically and it’s possible for them to drop suddenly. If your assets are low in value, the difference between a large price drop will be more than any interest earned from them.

- When withdrawing or unstaking your cryptocurrency, you may be subject to an unstaking period of seven days or longer

The biggest risk you face with crypto staking is that the price goes down. Keep this in mind if you find cryptocurrencies offering extremely high staking reward rates.

For example, many smaller crypto projects offer high rates to entice investors, but could have big fluctuations in their price leaving yu with less original currency than you started with. If you’d prefer less risk when adding crypto to your portfolio, choosing a larger and more established cryptocurrency might be better.

Although crypto that you stake is still yours, you need to unstake it before you can trade it again. It’s important to find out if there’s a minimum lockup period and how long the unstaking process takes so you don’t get any unwelcome surprises.

We hope you have found this article helpful in understanding how to stake your crypto with Binance.

Disclaimer: The information provided on this page does not constitute investment advice, financial advice, trading advice, or any other sort of advice and it should not be treated as such. This content is the opinion of a third party and this site does not recommend that any specific cryptocurrency should be bought, sold, or held, or that any crypto investment should be made. The Crypto market is high-risk, with high-risk and unproven projects. Readers should do their own research and consult a professional financial advisor before making any investment decisions.